It’s really an interesting time to be an investor right now. With global risk, uncertainty and emotional warning signs around every corner, the world’s stock markets are thumbing their collective noses at it all. The US SP500 index has broken out to new highs and its price is above a rising 50 and 200-day moving averages, the sign of a healthy and strong uptrend. RSI momentum as also broken above its downtrend. Using on-balanced-volume (OBV) as a secondary confirmation indicator (bottom pane), it hasn’t batted an eyelash as it too, has broken out to new, all-time highs.

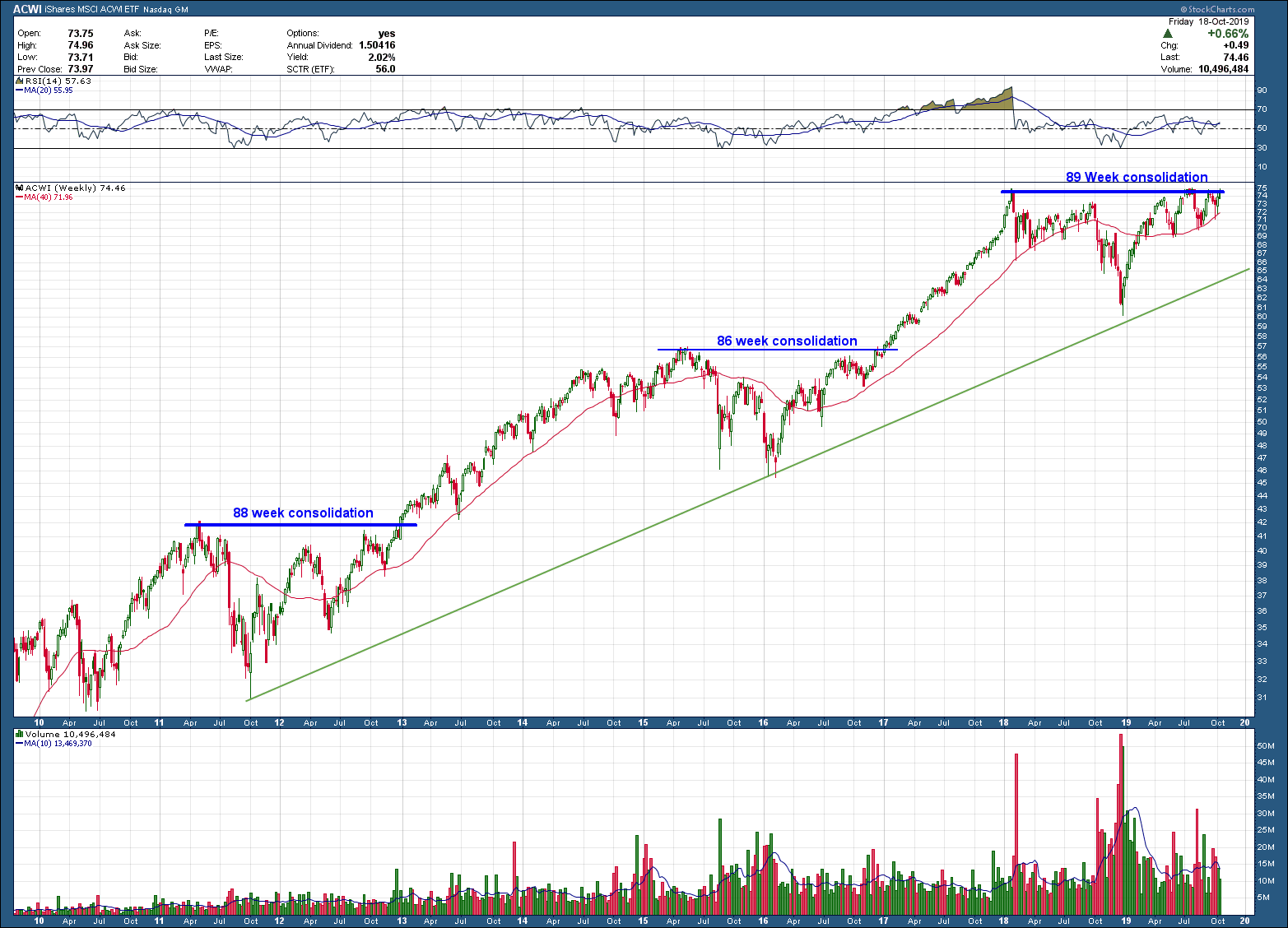

If you look across the globe, while few countries stock markets are at all-time highs, most have broken their downtrends and are positioning for a run higher. Whether this is anything more than just a reflexive, counter-trend bounce won’t be known until later but the message it is telling is very powerful to those who are listening, the risk trade is back on for global investors.