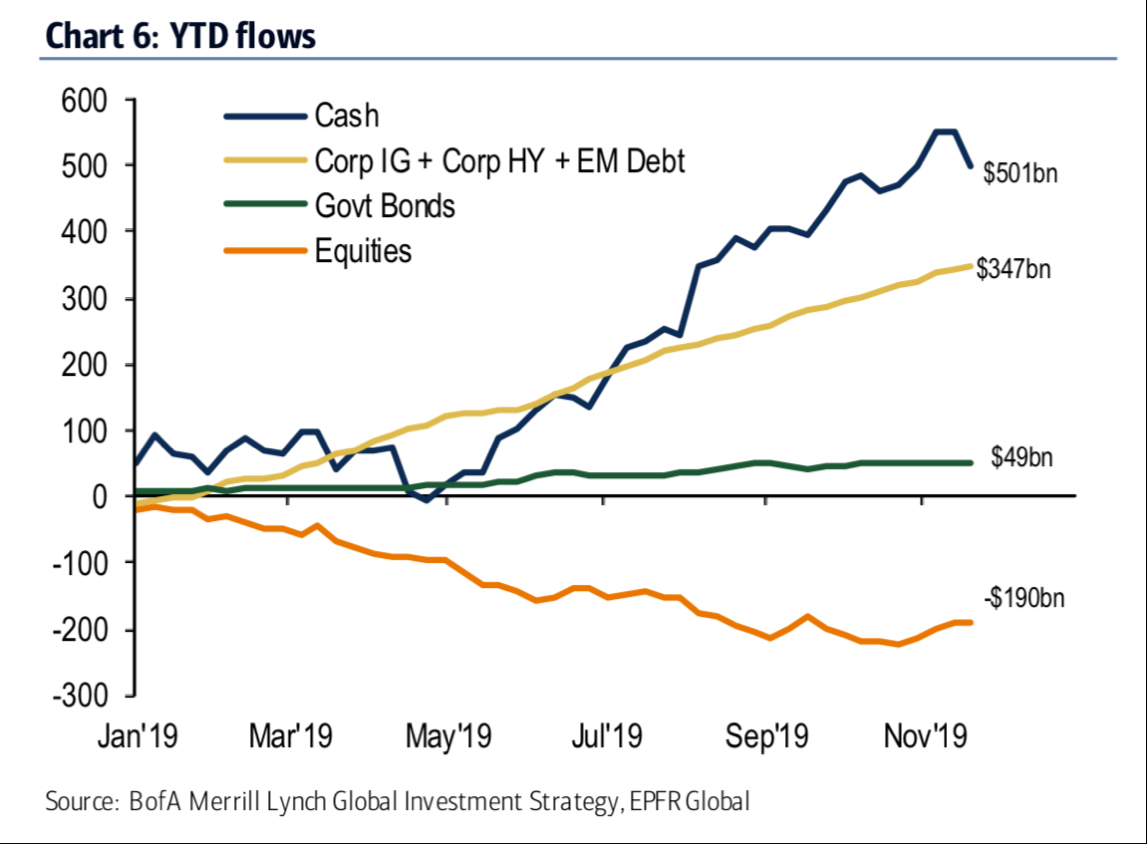

Now that we are less than 12 months from the next presidential election, it is appropriate to talk about how the stock market typically behaves during an election year. The short answer is that election years are up, on average, although not as strongly as the 3rd year of a presidential term. And when an election year sees a down stock market, as in 2000 or 2008, it is bad for the party in power.

This week’s chart shows our Presidential Cycle Pattern, which is an average of the SP500’s behavior over the 4 years of each presidential term. I choose to use a different definition of “year”, rather than the normal calendar year starting on January 1. I instead employ a count which starts each year on Nov. 1, to better align with the timing of the presidential election. I have found that the stock market starts reacting to whoever gets elected almost immediately, rather than waiting for the Jan. 20 inauguration to start reacting.

Generally speaking, the stock market goes sideways during the first two years of a president’s term in office. This is especially true in the first term of a new president. When a new president takes office, he typically spends the first 2 years “discovering” that things are even worse than he told us during the campaign, and that the “only solution” is whatever package of tax hikes/cuts and/or spending increases he hopes to get approved by Congress. Investors tend to get bummed out by hearing that conditions are worse than they thought, and so they are not in a mood to bid up stock prices.

Then after the mid-term elections, the new president typically spends the final two years of the term declaring victory for having fixed everything, and running for reelection. Investors respond by feeling better about hearing that everything is better now, and they tend to bid up the stock market during the 3rd year. Election years are iffier, because they hold the risk that we all might have to get used to some new President taking office, and so election years are still mostly positive, but not as much as 3rd years.

When President Trump won the election in November 2016, the stock market initially had a negative reaction, with SP500 futures getting locked limit down (5%) overnight, but then rallied strongly the next day and beyond. Curiously, though, the pattern of the SP500 during President Trump’s first 2 years did not correlate very well at all to the Presidential Cycle Pattern (PCP). Everyone seems to agree that President Trump is a “different sort of president”, and maybe that is the explanation for the curious lack of correlation.

Then starting after the spike bottom on Dec. 24, 2018, the SP500 started correlating really tightly with the PCP, as if a switch had been flipped and prices got locked into what the script says. Maybe President Trump is becoming more of a “normal” type of president now. Naahhh, that cannot be it.

This next chart zooms in closer on just the immediate relationship between the SP500 and the PCP: